IRS 1120S 2024-2025 free printable template

Show details

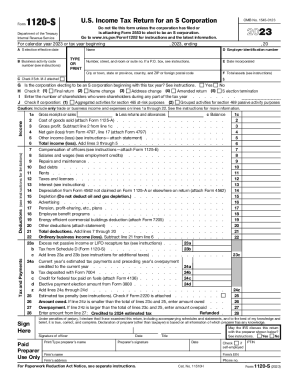

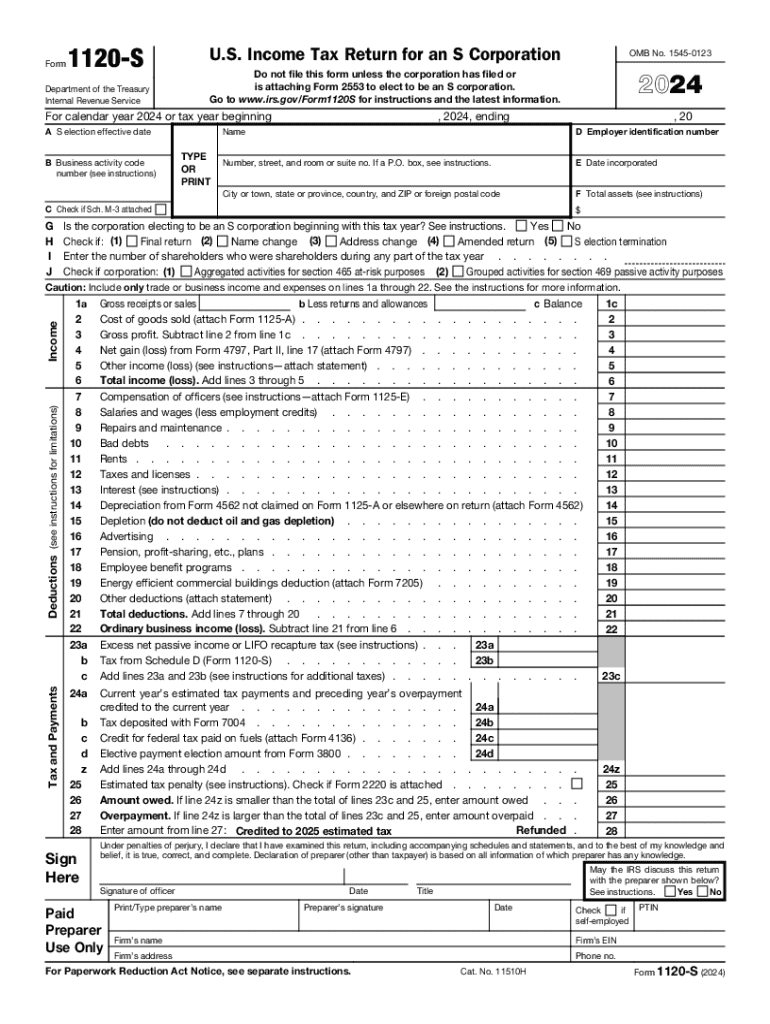

Form1120SDepartment of the Treasury Internal Revenue ServiceU.S. Income Tax Return for an S CorporationOMB No. 15450123Do not file this form unless the corporation has filed or is attaching Form 2553

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

Instructions and Help about IRS 1120S

How to edit IRS 1120S

To edit IRS Form 1120S, you can use pdfFiller’s features that allow you to modify text, insert data, or correct any mistakes. Once the form is uploaded to pdfFiller, select the 'Edit' option, make the necessary changes, and save your modified document. This makes it easier to ensure that all information is accurate before submission.

How to fill out IRS 1120S

Filling out IRS Form 1120S requires accurate reporting of a corporation's income, deductions, and credits. Begin by gathering all necessary financial documents, including income statements and expense records. Then, proceed to input the required information in each section of the form, ensuring compliance with IRS guidelines.

Latest updates to IRS 1120S

Latest updates to IRS 1120S

Stay informed about recent changes to IRS Form 1120S, including updates to tax rates, filing procedures, or eligibility requirements. Regularly check the IRS website or trusted tax preparation resources for the latest information to ensure compliance and accuracy in your filings.

All You Need to Know About IRS 1120S

What is IRS 1120S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 1120S

What is IRS 1120S?

IRS Form 1120S is the tax form used by S corporations to report income, gains, losses, deductions, and credits. This form is essential for S corporations to disclose their financial information to the IRS. By using this form, S corporations can pass profits and losses through to shareholders, avoiding double taxation at the corporate level.

What is the purpose of this form?

The purpose of IRS Form 1120S is to report the financial performance of an S corporation during the tax year. It allows the IRS to track the corporation’s income and expenses, ensuring compliance with tax regulations. The information reported on this form is also used to calculate each shareholder's tax liability based on their share of the corporation's income.

Who needs the form?

IRS Form 1120S must be filed by all S corporations, which are defined as corporations that have elected to be taxed as pass-through entities under Subchapter S of the Internal Revenue Code. However, not all corporations qualify for S corporation status; eligibility is contingent on criteria such as the number of shareholders and the types of stock issued.

When am I exempt from filling out this form?

Companies may be exempt from filing IRS Form 1120S if they do not have any income for the year, are classified as a different type of entity, or if they have opted out of S corporation status. In such cases, they may need to file either IRS Form 1120 for C corporations or another applicable tax form.

Components of the form

The major components of IRS Form 1120S include sections for reporting income, deductions, and shareholder information. Key areas comprise the income statement where corporations report total income, deductions for expenses, and information on distributions to shareholders. Understanding these components is crucial for accurate reporting.

Due date

The due date for filing IRS Form 1120S is typically March 15 for calendar year filers. If March 15 falls on a weekend or holiday, the due date is the next business day. Extensions can be requested, allowing corporations additional time to file without incurring penalties.

Form vs. Form

IRS Form 1120S differs from IRS Form 1120 in that 1120S is for S corporations, which benefit from pass-through taxation, while 1120 is for C corporations that face double taxation on profits. Understanding the distinctions is essential for corporations to ensure they file the correct form in accordance with their tax status.

What payments and purchases are reported?

IRS Form 1120S requires reporting of all business income and allowable deductions. Payments made to contractors, salaries paid to employees, and purchases of business assets are typically reported to ensure accurate calculation of net income. Accurate reporting of these figures is critical to compliance with IRS regulations.

How many copies of the form should I complete?

Generally, you need to complete one copy of IRS Form 1120S for submission to the IRS and another for your records. Additionally, copies may need to be provided to shareholders for their individual tax filings. Be sure to keep accurate copies for your business records to facilitate future audits or inquiries.

What are the penalties for not issuing the form?

Failing to file IRS Form 1120S can result in significant penalties. The IRS imposes fines for each month the form is late, which can add up to hundreds of dollars if not filed in a timely manner. In addition to fines, a failure to file can lead to scrutiny from the IRS or the need for corrective actions.

What information do you need when you file the form?

When filing IRS Form 1120S, collect detailed financial records, including profit and loss statements, balance sheets, and documentation for all deductions claimed. Additionally, gather information about each shareholder, such as their ownership percentages and any distributions received during the tax year.

Is the form accompanied by other forms?

IRS Form 1120S is often accompanied by other schedules and forms to report additional information. Commonly submitted forms include Schedule K-1, which details each shareholder’s share of income, deductions, and credits. Ensure all required documentation is filed together for proper processing by the IRS.

Where do I send the form?

The filing of IRS Form 1120S should be directed to the appropriate address based on where the corporation is located and whether the form is submitted via mail or electronically. Consult the IRS instructions for the most current mailing addresses for your specific situation, as these may change annually.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Work and Study Budy

Overall I love the app and all the features it offer! The benefits totally outweigh the cost. Amazing app!

What I like most about the feature is I can use it both for work to fill out pdf files and for my personal studies where I can write notes, comment, add highlights and more to the file.

What I least like about this is it can be a bit pricey to maintain especially if I were only a student. But good thing I am also using it for work so I can really maximize its use.

A very useful tool for PDFs

Very good experience. In my beginnings I had a little trouble but everything came very quickly. I mainly use it for my professional paperwork with the administrations when I need to edit some files and sometimes I use it to sign. Not only do we save paper but also if we don't have a printer or are on a mobile or the tablet one can use this application. It's great !

Multiple features, easy and practice of use, especially for the modification of documents.

One thing to take into account is that pdfFiller is not easy for one who doesn't know more about this kind of software. Slight bugs sometimes but otherwise nothing to report on the software.

PdfFiller - Sign

I adopted this tool from the first day

I can sign all documents without print them and scan them...

More expensive.It was better : new pricing plan : pay to sign for one document

There are many options for editing documents.

It was pretty easy to send my 1099's but would like a little more instruction on filling a 1040.

easy ,convenient and makes your work never easy than before

See what our users say