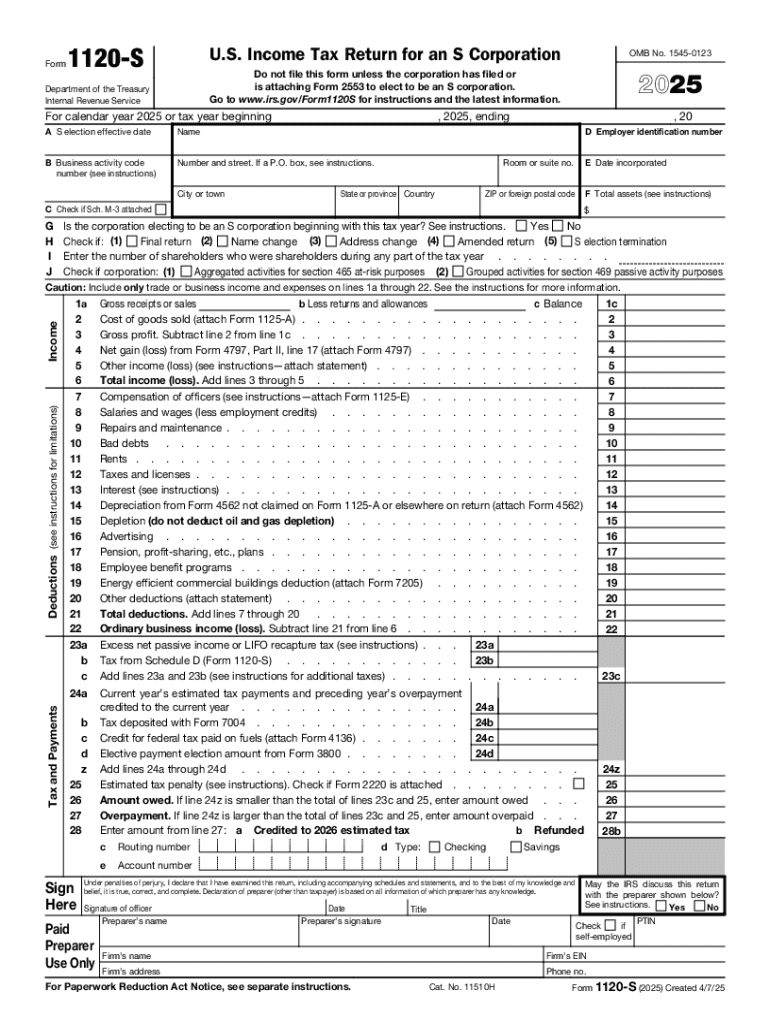

IRS 1120S 2025-2026 free printable template

Instructions and Help about IRS 1120S

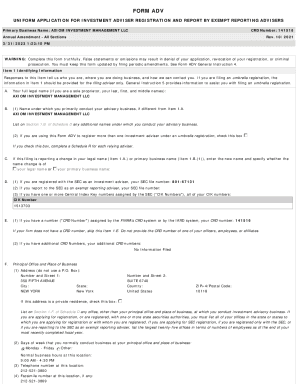

How to edit IRS 1120S

How to fill out IRS 1120S

Latest updates to IRS 1120S

All You Need to Know About IRS 1120S

What is IRS 1120S?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120S

What should I do if I realize I made a mistake after filing my IRS 1120S?

If you discover an error after filing your IRS 1120S, you should file an amended return using Form 1120S-X. It’s crucial to submit this as soon as possible to avoid penalties. Ensure that you keep copies of both the original and amended forms for your records.

How can I verify if my IRS 1120S has been received by the IRS?

To verify the receipt of your IRS 1120S, you can use the IRS e-file tracking tool if you filed electronically. For paper submissions, consider contacting the IRS directly to check your filing status. Be prepared to provide your business details for verification.

What are the common errors to avoid when filing IRS 1120S?

Common errors on the IRS 1120S include incorrect Social Security or EIN numbers, failing to report all income, and miscalculating deductions. Double-check that your figures align with your financial statements to minimize mistakes.

What should I do if my IRS 1120S submission is rejected?

If your IRS 1120S is rejected, review the rejection codes provided by the IRS. Correct any identified issues and resubmit your form promptly to ensure compliance with filing deadlines. Consider keeping records of the rejection letters and your corrections.

What are the privacy and data security considerations when e-filing IRS 1120S?

When e-filing your IRS 1120S, ensure that you use reputable software with data encryption. It's vital to safeguard sensitive information, such as your tax ID and financial records, and ensure that your internet connection is secure during the submission process.

See what our users say