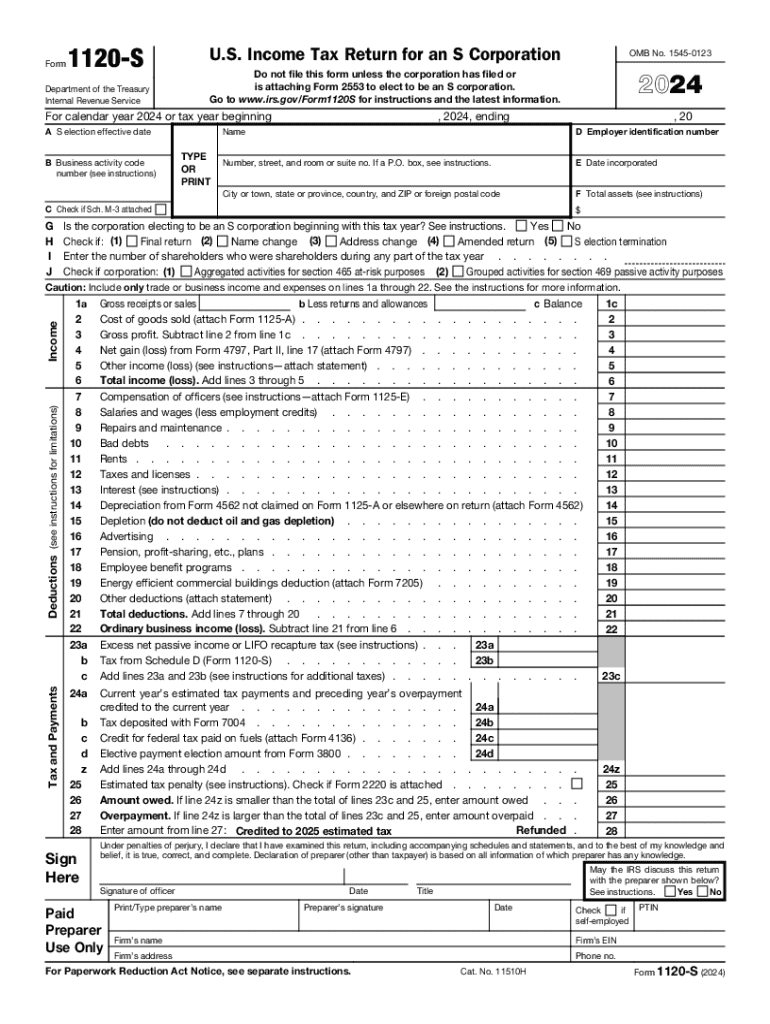

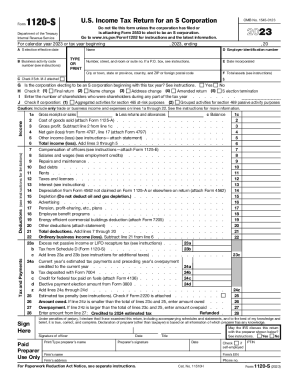

What is form 1120S?

The full name of the IRS form 1120S is Income Tax Return for an S corporation. This form reports S corporation’s income, gains, losses, deductions, credits, etc., to claim the annual amount of taxes owed to the US government.

Who should file form 1120S 2024?

S corporations must file form 1120S as an annual income tax return report. An S corporation is a type of business ownership structure that enables the business to avoid double taxation. Therefore, a corporate entity should not pay corporate income tax on the company's profits. The company’s shareholders are responsible for submitting individual income tax returns and paying their income taxes, including profits earned from the business.

What information do you need when you file form 1120S?

The 1120S form contains several tables that require the following information: income, deductions, tax, payments, etc. Before you fill out the form, make sure you have the following information at hand:

- Incorporation date

- Listing of the company’s products/services

- The company’s business activity code

- Employer Identification Number (EIN)

- The date when S corp status was elected (January 1 if the business operates on a calendar-year basis or the first day of the fiscal year if it operates on a fiscal-year basis).

- A balance sheet, profit, and loss statement

- The business’s accounting method

- Independent contract payments of at least $600 for the year

The form must be signed by the president, vice president, treasurer, assistant treasurer, chief accounting officer, or other corporate officer authorized to sign, e.g., tax officer.

How do I fill out form 1120S in 2025?

You can quickly fill out the 1120S tax form online in pdfFiller:

- Click on the Get Form button above

- Fill out the document providing actual information

- Add your signature

- Click Done to complete editing

- Select the form and required attached files in the list and click Send via USPS

- Provide the addresses and select mailing terms

- Click on the Send button

Soon it will be printed and delivered to the post office by pdfFiller — you don’t even have to leave your house.

Is form 1120S accompanied by other forms?

IRS instructs corporations not to file form 1120-S that have not previously filed or aren’t attaching form 2553, Election by a Small Business Corporation.

An extensive list of schedules (B, K, L, etc.) must be attached to the completed form 1120S. Use the detailed instructions on the IRS website to determine whether an S corporation is required to provide these schedules. Typically, this depends on the circumstances and structure of the filing S corporation.

When is form 1120S due?

The IRS expects the Income Return Reports to be submitted by March 15, 2022. You can mail the form to IRS or file it electronically.

Where do I send form 1120S?

File the form with your local IRS office. Find the address relevant for your state in form 1120S instructions on the IRS website.